Applying for a payday loan can often be a daunting and confusing process for many individuals. However, with the right knowledge and understanding, this procedure can be made much simpler and more manageable. In this article, we will provide you with a comprehensive overview of payday loan applications, explaining the steps involved and offering useful tips to ease the process.

Understanding Payday Loans

Before delving into the application process, it’s important to have a clear understanding of what payday loans are. Essentially, payday loans are short-term loans that are designed to provide individuals with quick access to cash to cover unexpected expenses or emergencies. These loans are typically repaid in full on the borrower’s next payday, hence the name “payday loan.”

Online Applications

One of the most convenient ways to apply for a payday loan is through online platforms. Online lenders have simplified the process by allowing borrowers to complete applications from the comfort of their own homes. To begin the application, individuals are usually required to provide personal information, such as their name, address, employment details, and bank account information.

Required Documentation

Alongside personal information, lenders may also request specific documentation during the application process. This documentation commonly includes proof of identity, proof of income, and proof of residence. These documents are vital for verifying the borrower’s eligibility and ensuring responsible lending practices.

Eligibility Criteria

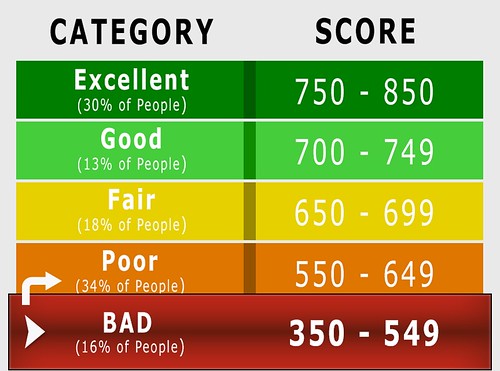

To qualify for a payday loan, applicants must meet certain eligibility criteria. These criteria may vary depending on the lender and the regulations of the specific jurisdiction. Generally, borrowers must be of legal age, have a steady source of income, and possess an active bank account. Additionally, lenders may also consider the applicant’s credit history, although payday loans are often accessible to individuals with poor credit.

What Are Some Alternative Options to Payday Loans?

When facing financial emergencies, exploring alternatives to payday loans is essential. Options such as personal loans from banks or credit unions can offer lower interest rates and more flexible repayment terms. Additionally, seeking assistance from friends and family, negotiating with creditors, or accessing community resources can provide alternative solutions to avoid the high costs and potential debt traps associated with payday loans.

Are Online Payday Loan Applications Faster and Easier Than Traditional Applications?

Fast track online payday loan applications provide a quicker and more convenient alternative to traditional methods. With just a few clicks, borrowers can submit their applications online, eliminating the need for paperwork and long waiting times. These applications are designed to streamline the loan process, enabling borrowers to receive instant decisions and access to funds within a matter of hours. Compared to tedious traditional applications, fast track online payday loan applications offer a faster and easier solution for those in need of immediate financial assistance.

Approval and Funding

Once the application is submitted, lenders typically review the provided information and conduct a quick assessment of the borrower’s creditworthiness. If approved, the funds are usually disbursed within a short period, often on the same day or the next business day. The loan amount approved may depend on various factors, including the borrower’s income and the lender’s policies.

Responsible Borrowing

While payday loans can provide immediate financial relief, it’s crucial to remember that they come with high-interest rates and fees. Borrowers should only take out payday loans when absolutely necessary and ensure they have the means to repay the loan on time. Responsible borrowing is essential to avoid falling into a cycle of debt and financial instability.

In conclusion, understanding the payday loan application process is key to making it a smoother experience. By familiarizing yourself with the steps involved, gathering the necessary documentation, and ensuring your eligibility, you can navigate the process more confidently. Remember to borrow responsibly and only when necessary, as payday loans are designed for short-term financial assistance.

Leave a Reply